NoteBridge

Revolutionizing Non-Performing Loan Resolution.

Experience faster, compliant, and borrower-friendly alternatives to foreclosure

Built for community-focused banks and servicers.

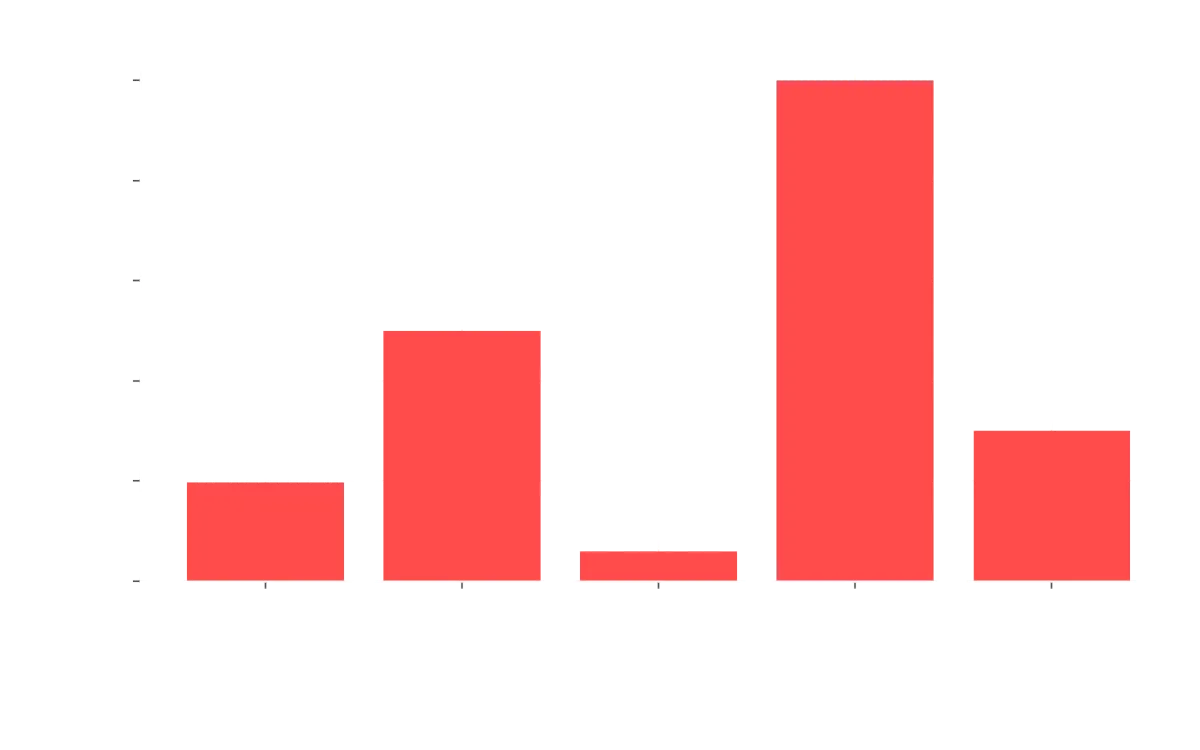

The Hidden Costs of Traditional Foreclosure.

Banks are losing an average of -$63,950 every time they have to foreclose — and most don't even realize it...

Not to mention opportunity cost and damaged reputation.

Legal fees

Property Maintenance & Holding

Administrative & Court Fees

Loss in Property Value

Opportunity cost

$3,000–$6,900

$10,000–$15,000

$1,000–$2,000

$20,000–$30,000

$5,000–$10,000

TOTAL AVERAGE LOSS: -$63,950

Foreclosure doesn’t just cost money — it burns time, breaks borrower trust, and puts your brand at risk.

Introducing Resolution Intelligence™: The Future of Loan Resolution.

NoteBridge uses Resolution Intelligence™ to replace foreclosure with real-time resolution — no courtroom, no re-lending, no borrower drama.

Upload the file. We match it with capital. You're out — clean.

6 MONTHS? TRY 60 SECONDS.

How It Works — Resolution, in 3 Clicks

From upload to outcome, here’s how it works — without courtrooms, call centers, or wasted months.

📤

1) Upload Your NPN

Send us just the essentials: payoff, borrower status, and balance. That’s it — no paperwork, no back-and-forth.

🤖

2) AI Reviews & Matches

Our Resolution Intelligence™ engine instantly identifies the best outcome — and matches your file with vetted capital in seconds.

💸

3) Capital Partner Steps In

Our investor partners step in to reinstate or recover the loan — no foreclosure, no re-lending, no stress.

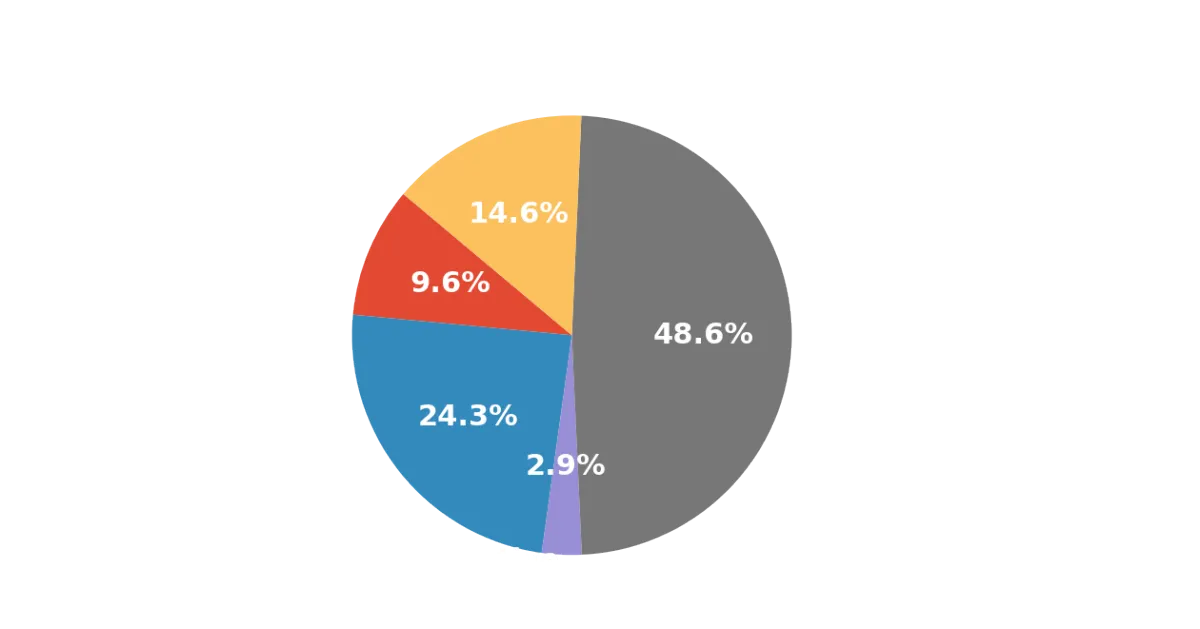

90% OF LOANS STAY IN PLAY

In over 90% of cases, NoteBridge resolves the loan without foreclosure — and keeps your capital in play.

Backed by trusted capital partners, insurance, and third-party servicing, you stay protected while the loan stays active.

Our vetted partners reinstate or acquire the loan — using compliant trust structures and built-in protections.

That means you keep the loan performing — without lifting a finger or reissuing a new note.

And the Other 10%? Still Handled.

When reinstatement isn’t viable, NoteBridge’s Resolution Intelligence™ routes the file to the next-best exit — instantly and with care.

In rare cases where reinstatement isn’t possible, NoteBridge identifies the most responsible and compliant exit — whether that’s a 🏠 short sale, 📝 deed-in-lieu, or 🤝 borrower-assisted transition.

We work through a vetted network of legal, servicing, and compliance professionals to ensure every exit is executed with transparency, dignity, and institutional protection.

Because even when a file can’t be saved, your brand and balance sheet still deserve to be.

Resolution, no matter the scenario.

Why Banks Are Making the Shift (Now)

A Smarter Path Forward.

Until now, foreclosure was the default — even when it meant long delays, rising costs, and borrower conflict.

Today, there’s a better way to resolve loan hardship — faster, quieter, and fully compliant.

🔴 The Old Way

• Public foreclosure — borrower panic and brand blowback

• Legal battles, courtrooms, and drawn-out timelines

• Borrower resistance and reputational risk

• Costly re-lending, delays, and lost time

• You chase files. Everyone loses.

🟩 The New Way (NoteBridge)

• Private resolution — quiet, fast, and clean

• No courts. No relending. No drama.

• Brand protected, borrower respected

• Fast capital match — no new loans

• One-click file upload. Resolution in motion.

Foreclosure didn’t evolve — until now.

Now there’s a faster, cleaner way to resolve distressed loans.

Case Studies – See It in Action

Real stories. Real resolutions. All without foreclosure.

✅ Foreclosure Avoided in 3 Weeks

🕒 Resolved Pre-Auction

💡 Note Back to Performing

📍 Broken Arrow, OK – Owner-Occupied SFR (2,929 sq ft)

Problem:

Borrower faced serious health issues and couldn’t make payments. The home was in rough condition and just two weeks from foreclosure auction.

Risk for the Bank:

If foreclosed, the bank would’ve inherited a distressed asset with legal costs, property loss, and repetitional risk.

Intervention:

NoteBridge brought in a qualified investor who reinstated the loan and began rehabbing the property — all within 3 weeks.

Outcome:

Lender recovered arrears and kept the loan performing, without re-lending or replacing the note.

Stability:

Today, the note is backed by a strong payer and serviced by a third party — ensuring reliable monthly payments.

📍 Sapulpa, OK – Vacant Inherited Property

Problem:

After the borrower’s husband passed, the home sat vacant for years. Over $40,000 was owed in arrears and taxes.

Risk for the Bank:

Foreclosure had been filed months ago but kept getting delayed. The bank risked inheriting a non-performing, high-liability asset.

Intervention:

NoteBridge helped structure a loan modification and brought in an investor to resume payments on the borrower’s behalf.

Outcome:

The lender avoided foreclosure and retained the note — now performing again without issuing a new loan.

Stability:

Loan is now serviced professionally with consistent, investor-backed payments in place.

📍 Sand Springs, OK – Divorce & Employment Loss

Problem:

Borrower fell behind on payments after divorce and job loss. He knew he couldn’t catch up — even on the standard payment.

Risk for the Bank:

The lender had filed foreclosure, escalating borrower distress and legal risk.

Intervention:

NoteBridge placed a capital partner who reinstated the loan and took responsibility for the property.

Outcome:

The lender recovered arrears, avoided foreclosure, and kept the note active — no new capital required.

Stability:

Loan is now performing and serviced by a third-party, with financial backing in place.

Built to Protect All Parties

Every resolution is executed through trust-backed structures and insurance for full compliance and privacy — protecting your institution, your reputation, and your borrowers.

Become a Founding Partner

Get the Competitive Edge

This is your once-only chance to be part of the shift from foreclosure to Resolution Intelligence.

We’re inviting 20 early-adopting institutions to help shape the future of loan resolution — and gain a permanent edge in the process.

⚙️ Resolution Power

✓ 50% lifetime license discount

✓ 1:1 resolution consulting with our founding team

✓ Priority case handling & private support

🏛 Strategic Positioning

✓ Founding badge + national brand recognition

✓ Influence on product roadmap

✓ Public positioning as an RI-aligned lender

🚀 Early Access Advantage

✓ Access begins in 90 days — before public rollout

✓ Personalized onboarding + workflow mapping

✓ Founding Partner updates and tools

Bonus: Strategy Session For Founding Partners

A 90-minute live call with our team where we’ll:

Uncover hidden resolution bottlenecks

Design a capital recovery plan

Map your first 90 days for maximum performance

This bonus alone has saved institutions 6 figures — and it’s never been offered publicly.

License Value: $15,000/year

Founding Partner Offer: $6,000 (one-time)

Only 20 seats available — then we launch.

|Access begins in 90 days — giving you priority onboarding, private support, and first-mover advantage.

Your Platform to Offload NPNs — in Minutes

Spend less time chasing down borrowers — and more time funding your next great deal.

Stop chasing borrower issues. Start resolving files in real time.

“We built NoteBridge because foreclosure was never meant to be the only option. It’s time lenders had a system that moved with the speed of the real world.”

— Founder, NoteBridge (Powered by Lucra)

— Founder, NoteBridge (Powered by Lucra)

TESTIMONIALS

"Highly recommend this"

“One file was resolved in 11 days. No court. No pain. Just results.”

- Your Name

Join the movement replacing foreclosure with clarity.

Community lenders deserve better. Borrowers deserve dignity.

Let’s lead the future of resolution — together.

Powered by Lucra — the infrastructure for intelligent resolution™.

Copyrights 2025 | Terms & Conditions